The daily news and our own experiences seem to signal that the UK is in decline. Services that had always seemed certain in our lives are under threat.

Benjamin Franklin did warn that ‘in this world nothing can be said to be certain, except death and taxes.’ Those taxes take nearly four out every ten pounds that we earn.1 The Government’s spending decisions are changing the way we live and the sort of society we live in. The future looks bleak. More than one trillion pounds was spent in 2023/2024.1 Where has all this money been spent? What has gone wrong?

“If you want to understand how it all works … then this 320-page explainer will give you an easy-to-read … overview …”

Paul Johnson follows our tax money, explains where all the Government’s money comes from, where it goes to, how that has changed in the past, and how it needs to change in the future. Johnson is the Director of the Institute for Fiscal Studies, a non-political organisation founded to check if the Government’s fiscal numbers add up. His CV includes being a columnist for The Times, working as chief economist at the Department for Education, and as director of public spending at HM Treasury, where he also served as deputy head of the government economic service.

The UK has changed dramatically in the last 50 years. Examples include how our state industries have either disappeared or been privatised; how the welfare state has vastly expanded; how local government has been stripped of many of its powers and become more of a vehicle for delivering social care; how the devolved governments have gained control over spending and some taxes; and how Brexit impacts us.

Further changes are inevitable. Too often governments seem to have no long-term strategy and instead use empty rhetoric and tinker with the mechanics of government including taxation, with little consideration of all the consequences. Politicians complain that when they get into government and reach for the levers of power to make changes, they discover the levers are not connected to anything. According to Johnson, the dirty secret is that governments do know what to do but choose not to because they are scared they will lose votes.

Hard choices about what is important and what needs to be done are everywhere and increasing. These will need tax reforms, planning reforms, and other changes. They may not be popular, but we need competent politicians as leaders. Most of us have a limited understanding of the fiscal world that relates to taxation, public revenues, and public debt. Johnson understands it, and can clearly and concisely tell a story that explains our taxes and follows the money to see how wisely it is spent.

“Services that had always seemed certain in our lives are under threat.”

If you want to understand how it all works (or does not work) then this 320-page explainer will give you an easy-to-read and up-to-date overview of where we are, how we got here, and what needs to be done.

There are forensic examinations of the main parts of government’s fiscal world. These include: the origins of current receipts from, and problems with, all our taxes; the burgeoning welfare benefits system; our schools and further education; our pensions; levelling up and local government; and the costs and quality of the health services. The bad historical decisions and their consequences are described.

Johnson makes suggestions for improving the NHS:

1. treat it like any other public service, acknowledge the problems rather than ignore them, and massively improve its management;

2. accept it will need a lot more funding;

3. focus more on the funding of primary care and out-of-hospital care, but also invest in capital equipment;

4. stop all the reorganisations;

5. follow up last year’s workforce strategy and make sure it is developed, funded, and implemented properly; and

6. design and run the system with the patient in mind.

What can be done? The next government will have fiscal problems and limited options for improvement. Nevertheless, we can expect more crises in the future from the climate change, pandemics, wars, and the unexpected.

We cannot prepare for every eventuality, but we do need to be able to respond flexibly when the crisis comes. This needs good government. A thriving economy with faster growth would help the UK improve and Johnson gives six suggestions:

1. ensure maximum political and macroeconomic stability;

2. provide high-quality education for all;

3. invest in infrastructure;

4. reform the tax system;

5. develop the closest and freest possible trading relationship with the European Union; and

6. sort out the planning system.

All the difficult but manageable decisions postponed by government fester and become more painful over time. None of these changes are easy but, according to Johnson, they are not impossible either.

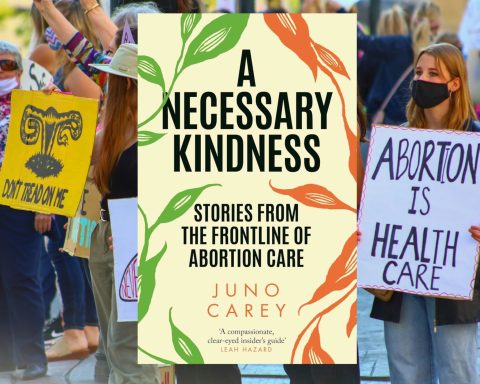

Featured book: Paul Johnson, Follow the Money: How Much Does Britain Cost? Abacus, 2024, PB, 320pp, £10.31, 978-1408714010

Reference

1. Johnson P. Follow the Money: How Much Does Britain Cost? London: Abacus, 2024.

Featured photo by Ming Jun Tan on Unsplash.